Why Do You Need an Emergency Fund?

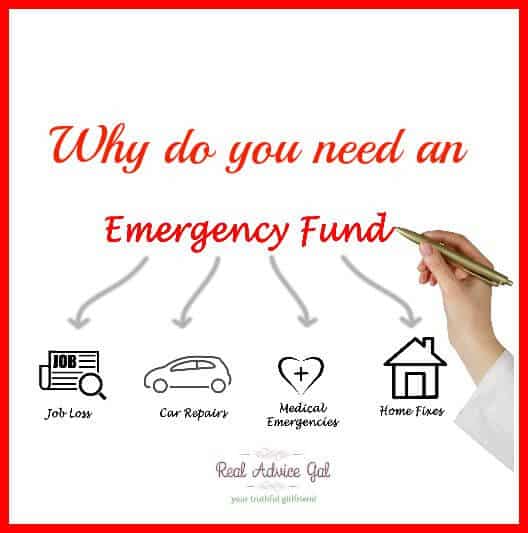

Do you ever wonder Why Do You Need an Emergency Fund? It’s easy to wonder if this is important, but also how to make it happen. We have some tried and true reasons and tips here for you to understand more about why an emergency fund is a necessity no matter what your current financial situation may be.

Why Do You Need an Emergency Fund?

Why do you need an emergency fund (part 1) ?

As some of the readers may have noticed, my regular series “How to thrive and not just survive under $30,000 a year” has not been around for a few weeks. One of the major reasons is because of a hard financial lesson I just learned. Most of the information in my blog posts comes from my own personal experience and doing a lot of research to figure out how to run the “business” that is my family the best I can. I have always been of the opinion that you shouldn’t spend money that isn’t yours (i.e.. credit card debt). Over the years, I have learned that building credit is equally as important as paying your debts. For that reason, we have embraced using credit cards in a controlled way.

Here is where our newest lesson comes in, my husband has always kept a savings account and I have made fun of him for years about it. I’ve never understood the point of having a savings account when you have credit card debt. The interest you earn on the savings account does not equal the interest you spend on using credit cards. When my husband was laid off from his office job and decided to go back to school we used up all of our resources to get through that time that no money was coming in. Our “safety net” has always been credit cards. I figured that in case of an emergency we always had a reserve of money in them.

Then we discovered a leaking pipe in our kitchen wall. A huge cascade of problems has snowballed since then. A leaking pipe turned into water damage in the floors and cabinets and then… the dreaded black mold discovery. I am currently in my third trimester of my third pregnancy with two small children at home and two cats. We had to think of everyone’s safety and move out of our house while everything is being taken care of. Thankfully, our home insurance policy seems to be able to take care of everything. The one thing we didn’t anticipate was the $1000 deductible. Guess what can’t be paid with a credit card? You know what else can’t be paid with a credit card? Our mortgage. So after the one thousand dollars that we had to pay out to fix the house, we didn’t have money for our mortgage payment. This is where that savings account would’ve come in handy. $1000 is a large sum to come up with quickly if you live on $30,000 a year. On the flipside, $1000 is not a lot of money to save up if you are frugal enough to live on $30,000 a year.

We were lucky because my in-laws stepped in to help. Most people though do not have that option though. Making the building of an emergency fund a priority should not be put off because you know what is worse than owing credit cards? Owing family or friends.

Please come back next week to read Part 2 of my Why Do You Need an Emergency Fund story.

Read part 1 of Angie’s Living on $30,000 Best Frugal Tips on Thriving and (not just surviving) on $30,000 a year!

Part 2 – Basic Home Budgeting

Part 3 – How to Budget Monthly Finances Wisely

Part 4 – How to Not Spend Money

Part 5 – Smart Money Saving Tips to Control Your Debt

Part 6 – Money Management Skill

Part 7 – Why Couples Should Talk About Money?

How to Use Your Tax Refund to Build Wealth

How to Manage Food Budget for Family?

Angie Rumpf

I am a stay at home mom and happily married to my husband Tom. I have a five year old daughter and a two and a half year old son. I grew up in Orlando, but went to school in New York City and lived in Los Angeles before moving home to raise a family. I have worked in the film industry since the early nineties, and for over a decade with the Florida Film Festival. I also spent many years working in marketing with Glaceau and Honest Tea. But, I am happiest at home building my family.

For more Best Frugal Tips, read these:

How to get rich in 5 minutes a day

Frugal Ways to Save Money: Getting Out of Debts

How to Save Up Money: Tips for Living on $30000 or Less

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal