7 Secrets on How to Budget Money Successfully

How to Budget Money Successfully

There are many secrets on how to budget money successfully, but these are the ones that have worked for me! It’s important to be flexible, and to understand that learning a new budget will take time. Be okay with that fact, and things will run smoothly (or at least smoother than they would have originally).

7 Secrets on How to Budget Money Successfully

1. Have a goal. Not just a random-maybe-some-day goal, but an actual exact goal. Whether you want to save $3,000 to take a family vacation, save $10,000 to put a down payment on your first home, or just pay your credit cards off… a clear and actionable goal is the first step to a successful budget. Keep your eye on the prize, and you will achieve your specific goals much faster than if they were just general ideas.

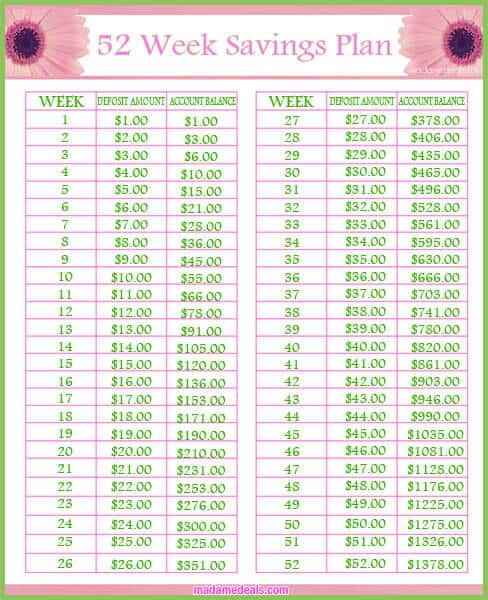

2. Keep a timeline. Figure out how much you need to save each week (or month) to achieve your goal in the time frame you’re hoping for. Obviously, sometimes things do come up. That’s okay! Just pick up where you left off, and adjust your timeline as needed. However, be strict when adjusting the timeline. If you know you can readjust as needed, you might not be as motivated to save.

3. Keep it simple. Your budget can be as simple as you want it to be. Whether you have twelve categories, or three categories, the key is to keep track of incoming and outgoing. So, you have your income category, and your expenses category. From there, divide the expense categories up. Household bills, debt, savings, giving – four categories that keep it super simple, while still getting the job done.

4. If you’re trying to cut back on spending in a certain area, create more categories. Entertainment, eating out, shopping, etc… these are all things most of us can cut back on – and will if we see in black and white how much we are spending each month.

5. Track your spending. Like I just mentioned in Tip #3, if you’re trying to cut back on your spending, you have to track it! No, it’s not fun to realize you’re spending $100 at Starbuck’s each month – or that every time you “run to Walmart for one thing” it’s a $200 trip, but it’s necessary to get on track with a budget.

6. Be honest with yourself. To follow up on tracking, being honest with yourself is also necessary to get on track – and stay on track – with your new budget. Be realistic about what you will and will not cut out of your budget. Will you really give up your coffee every morning? Maybe, maybe not – but don’t say you will, when you probably won’t. Just factor it in and budget as necessary.

7. Buy gift cards. I do this often, because I can get gift cards at a discount (or with cash back) from sites like Ebates. If you are serious about cutting back on your Starbuck’s habit, buy a $50 gift card at the beginning of the month and when you’re out, you’re out. You can do this with Amazon, Target, pretty much any store really – wherever you need to cut back.

Do you have tips on How to Budget Money Successfully? Share it with us below.

Also check out these money saving tips:

How to Save Up Money: Tips for Living on $30000 or Less

Living on 30000 or Less: Raising a Large Family

5 Tips on Living on 30000 or Less

Savings Challenge: 52 Week Savings Plan

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal