5 Tips for Paying off your Car Quickly and Lower your Car Insurance!

5 Tips for Paying off your Car Quickly and Lower your Car Insurance!

Well as off last month, we did it, we paid off our first car! Woohoo! Paying off our family’s first car is one of the best feelings I’ve had as an adult, not to mention, having that extra money in our account feels nice too ha! We paid off our car in less than 5 years, and I consider that pretty good timing right!? We did sacrifice some things to be able to pay off our car early, but not having a car payment for the next 10 years seems to be worth it for our family. I wanted to share 5 tips for paying off your car quickly with you guys, because I’m sure some of you are tired of paying that huge car payment every month right?I also wanted to share with you a great way to lower your car insurance, which will not only help you pay off your car quickly and help you after your car is paid off! You ready to get started? Lets go!

5 tips for paying off your car quickly:

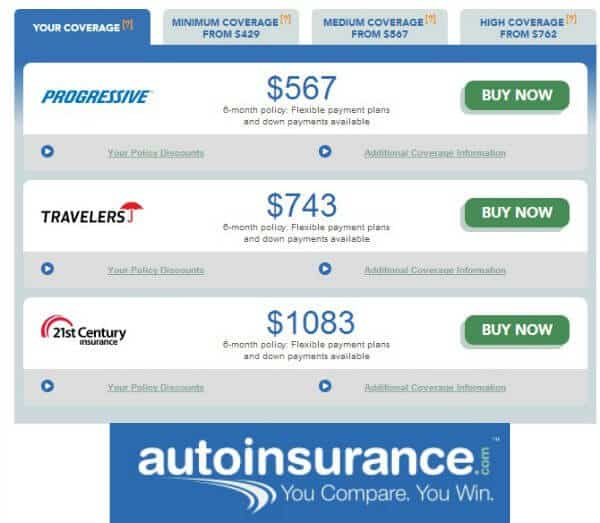

1. Compare Auto Insurance! Perhaps one of the most easy (and important!) ways to pay off your car quickly, comparing auto insurance is super important because you can save tons of money (and still get great coverage). AutoInsurance.com is a great source for comparing Auto Insurance, and something I have personally used. (Note: this website is only available to people in Texas, Arkansas, Oklahoma, Missouri, Louisiana, Tennessee, and Mississippi right now). Reviewing your car insurance options quarterly can help your rates stay manageable, and will ensure you know you are getting the best coverage for the best rate.

AutoInsurance.com is super easy and user friendly! The whole process took me about 5 minutes, and a little information! This is a FREE service and really helps lay all your auto insurance options right in front of you!www.AutoInsurance.com is a first-of-its kind, independently operated one-stop-shop site that empowers consumers to quickly search, compare and purchase auto insurance, saving time and money online, consumers can retrieve their current auto insurance policy information and compare it apples-to-apples with carrier quotes offered on www.autoinsurance.com!Currently consumers can compare quotes from up to six top national carriers: Progressive, Travelers, Esurance, 21st Century, The General and Safeco!

By using this service we found out that we could be saving about $30/month if we switched our carrier! We plan on putting that money toward a second car in the future!

Want more information on AutoInsurance.com? Make sure to visit their website and stay up to date by following them on Facebook and Twitter!

2. Cut out Unneeded Expenses- A car payment is one of the biggest monthly expenses (at least for our family) and a constant one. We cut out things like eating out, high priced cable packages, and other things that we didn’t need. Doing this allowed us to pay our car payment on time, and over the minimum amount. (Side note, Netflix is your friend. $8/month for a huge amount of shows, who needs cable anyways!?)

3. Consider paying off the remaining balance on your car in 1 lump sum- Some car loan companies will allow you to pay off your remaining car loan balance in 1 lump sum, which will decrease your interest, and in some cases may even lower your remaining balance. Give your car loan company a call and ask if this is something they do.

4.Make additional monthly payments- If you have a fixed monthly rate, find out of you can pay extra toward your principle each month. Any extra money monthly you can pay will help you pay it off sooner.

5.Apply any extra income to your car payment- We paid off our car by putting our tax refund and my husbands bonus toward our car payment. It didn’t affect our monthly bills since it was extra money, and it was so awesome to send that last check in!

So there you have it! 5 tips for paying off your car quickly and lower your car insurance!

Do you have any tips for paying off your car quickly? Let us know in the comments below!

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal